PNM Kembangkan Kredit Pedagang Pasar di DKI Antisipasi Rentenir

Indonesia`s PNM Venture Capital Expand Credit for Traditional Market Traders

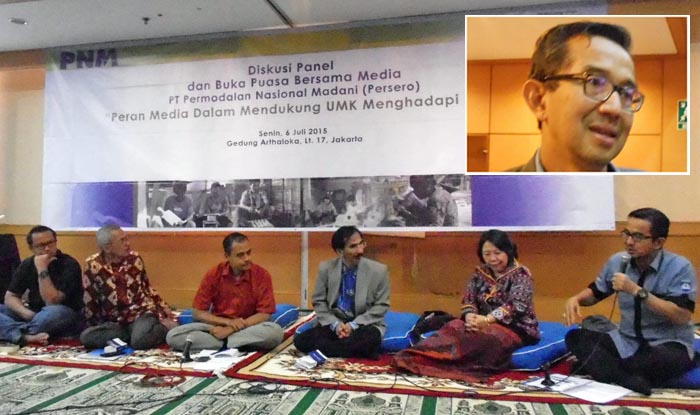

Reporter : Gusmiati Waris

Editor : Cahyani Harzi

Translator : Dhelia Gani

Jakarta (B2B) - PT Permodalan Nasional Madani (PNM) berencana penyaluran kredit untuk pedagang pasar tradisional di DKI, setelah sukses mendukung permodalan pedagang di 52 pasar tradisional di Bali sejak 2013, dengan bunga pinjaman 30% hingga 40% per tahun untuk mengantisipasi kredit berbunga tinggi dari para rentenir dan tengkulak yang berkeliaran di pasar tradisional.

Presiden Direktur PNM, Parman Nataatmadja mengatakan selama ini kredit mikro hanya fokus pada pedagang kecil atau pedagang kaki lima, dan bukan menyasar pedagang yang telah memiliki toko atau kios di pasar-pasar tradisional.

"PNM sejak dua tahun lalu mengembangkan kredit pedagang pasar di Bali, kini PNM akan membuat pilot project untuk pasar-pasar tradisional di Jakarta dan setelah sukses kemudian dikembangkan ke provinsi lain di Indonesia." kata Parman Nataatmadja kepada pers usai buka puasa bersama di Jakarta, Senin (6/7).

Menurutnya, target debitur PNM adalah pedagang yang membutuhkan tambahan modal seperti para pedagang sayur mayur, dengan plafon kredit tertinggi Rp10 juta untuk pedagang di pasar tradisional.

Parman menambahkan, bunga kredit yang ditawarkan PNM bervariasi, 30% hingga 40% per tahun, dengan pinjaman maksimal Rp10 juta berjangka satu hingga tiga bulan yang bertujuan mengantisipasi praktik rentenir maupun tengkulak yang menawarkan bunga tinggi yang mencekik leher.

"PNM sudah berpengalaman mengelola kredit pedagang di 52 pasar tradisional di Bali, dan rencananya kami akan menambah penyaluran kredit ke lima pasar lagi di Bali," tambah Parman.

Corporate Communication PNM, Zulfikar Nurramdansyah Tjais mengatakan meskipun nasabahnya adalah pedagang kecil, PNM mampu mencegah kredit macet hingga 0%.

"Kreditor dari pedagang pasar ternyata patuh dan tertib karena ditagih harian, dan saingan PNM bukan bank melainkan tengkulak karena memang tujuan PNM mengatasi aksi mereka," kata Zulfikar.

Jakarta (B2B) - Indonesia's state-owned enterprises (SOEs), PNM Venture Capital, locally known as the Permodalan Nasional Madani or PNM, is planning to expand lending to the traditional market traders in Jakarta, following the successful supporting the merchant's capital in 52 traditional markets in Bali since 2013, at an interest rate 30% to 40% per year to anticipate the moneylenders, and middleman who roam the traditional market.

President Director of PNM, Parman Nataatmadja said, microcredit has been only focused on small traders or street vendors, and not targeting traders who have shops or stalls in traditional markets.

"PNM since two years ago provide loans to the traditional market traders in Bali, now we will make a pilot project in Jakarta and later to other provinces in Indonesia," Mr Nataatmadja told reporters after iftar here on Monday (6/7).

According to him, the target is the debtor PNM market traders with the highest credit limit of 10 million rupiahs.

Mr Nataatmadja added, PNM lending varies 30% to 40% per year, with a maximum of 10 million rupiahs loan term of one to three months, to anticipate the practice of moneylenders who offer high interest strangle the neck.

"PNM has experience managing credit for traders in 52 traditional markets in Bali, and we were planning expand to five traditional market in Bali," he said.

The PNM Corporate Communication, Zulfikar Nurramdansyah Tjais said although the PNM customers are small traders, the PNM able to prevent bad debts up to 0%.

"The debtors in traditional markets turned out to obedient and discipline who pay in installments day, and rival of PNM is not a bank, but moneylenders because it the target of PNM," Mr Tjais said.